You should consider the financial implications of retiring abroad when you are considering it. Find out whether the area has medical facilities, whether there is a local doctor, and how long it takes for a prescription to be filled. It is important to find out if there are any taxes. Take a look at the current status of your health insurance to determine how it might change in a new place.

Coverage for medical insurance

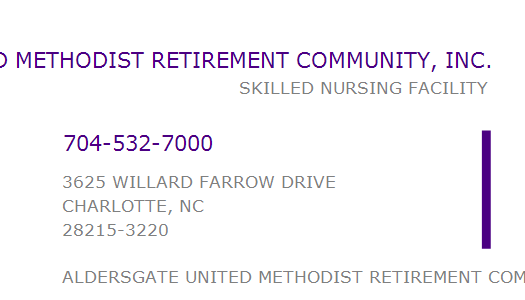

It can be difficult to retire in the U.S. if you are not able to access health care in rural locations and have high medical bills. Medicare does not cover expatriates who live in another country. This means that there are three options for paying medical care. These are some tips to help you make an informed decision about medical care abroad.

Planning ahead

Planning ahead is essential before you decide to retire abroad. You should consider your financial situation, cultural background, and distance from family members and friends. Full-time or part time plans are options. To find out if the culture or economy is right for you, visit the destination. A comprehensive guide is available from the U.S. State Department about retiring abroad. Decide if you would like to live permanently or part-time in the country. Once you have chosen a destination, investigate its political and economic stability.

Costs

Certain expenses are important to know if you plan on retiring abroad. Medicare does not cover people who retire outside the U.S. So you will need to have a foreign insurance plan. A plan that covers multiple countries can be purchased for a significantly higher price than a domestic one depending on your individual circumstances. If your country has low healthcare costs you might be able to drop insurance completely.

Taxes

A US citizen can choose to take a retirement abroad without having to pay taxes on any of your income. If your global income exceeds certain thresholds, such as $12,000 per individual or $400 in self-employment income (or both), you will need to file a federal income tax returns each year. In addition, you must convert all of your assets and foreign income to U.S. dollars.

Places to retire

Although it may seem risky, you don't need to leave the US to retire. You don't need to learn a lot of language or adapt to a new lifestyle in order to retire in one of the many popular destinations. It's possible to have dinner with American expatriates. You will have fewer distractions, and higher living costs. You will also have access to nature and a better lifestyle.